Overview

Access this book

Tax calculation will be finalised at checkout

Other ways to access

About this book

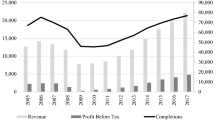

This book presents an analysis of the role of UK building societies, their strengths and weaknesses, and their contribution to the industry, at a time where public confidence in banking is low. Chapters present the results of an empirical analysis of the comparative performance of UK building societies, since the large-scale demutualisation process ended in the year 2000. The authors highlight the substantial impact of the financial crisis on the sector, with 2008 and 2009 being particularly difficult years. The book discusses banks and building societies in the context of the improving economy and show that both groups have recovered some profitability, although not at the pre-crisis level. The reader will discover that building societies in particular have recovered well from the financial turmoil and they appear less risky than banks on a variety of measures.

Similar content being viewed by others

Keywords

Table of contents (5 chapters)

Reviews

“In the interests of effective competition and systemic stability, there is a public policy interest in supporting diversity in ownership structures and business models in the financial services industry. This timely book offers an admirable and well-analysed redress to the dominance in the finance literature of the shareholder value model in finance by analysing in a coherent way the role of mutual building societies in the economy. The authors are eminently qualified analysts who offer an excellent and clear analysis of the role of building societies in the context of on-going structural change in the British financial system.” (David T Llewellyn, Professor of Money & Banking, Loughborough University)

“Thriving markets and ecosystems share characteristics of strong competition and great diversity. The banking sector is no different. This study helps deepen ourunderstanding of how the building societies responded to the 2008 financial crisis, and why they are a vital part of the UK’s broader banking sector in the 21st century.” (Robin Fieth, Chief Executive, Building Societies Association)

Authors and Affiliations

About the authors

Barbara Casu is the Director of the Centre for Banking Research at Cass Business School, City University London, where she is Professor of Banking. Her research interests are in the areas of banking, financial regulation, corporate governance and industrial organisation. Barbara has published over 30 papers in international peer reviewed journals, including the Review of Economics and Statistics and the Journal of Money, Credit and Banking.

Andrew Gall is the Economist at the Building Societies Association, the trade body for all UK building societies.

Bibliographic Information

Book Title: Building Societies in the Financial Services Industry

Authors: Barbara Casu, Andrew Gall

DOI: https://doi.org/10.1057/978-1-137-60208-4

Publisher: Palgrave Macmillan London

eBook Packages: Economics and Finance, Economics and Finance (R0)

Copyright Information: The Editor(s) (if applicable) and The Author(s) 2016

Hardcover ISBN: 978-1-137-60207-7Published: 05 July 2016

eBook ISBN: 978-1-137-60208-4Published: 25 June 2016

Edition Number: 1

Number of Pages: XIX, 101

Number of Illustrations: 35 b/w illustrations

Topics: Financial Services