Overview

- Explains U.S. QI and FATCA regulations in ways that allow financial institutions to understand their compliance obligations and take practical steps to meet them

- Builds on the basic framework of the QI and FATCA and provides updates over the last 5 years

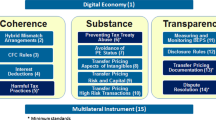

- Includes two new chapters on AEoI/CRS and BEPS

- Includes explanatory material on Section 871(m) and QDD

Part of the book series: Global Financial Markets (GFM)

Access this book

Tax calculation will be finalised at checkout

Other ways to access

About this book

This second edition builds on the basic framework of the QI and FATCA frameworks by updating the text to encompass the changes that have occurred since the book’s original publication. This edition will also delete material that has become obsolete or was proposed by the IRS originally but never implemented.

Similar content being viewed by others

Keywords

Table of contents (18 chapters)

-

Front Matter

-

Related Global Tax Initiatives

-

Front Matter

-

Authors and Affiliations

About the author

Bibliographic Information

Book Title: US Withholding Tax

Book Subtitle: Practical Implications of QI and FATCA

Authors: Ross McGill

Series Title: Global Financial Markets

DOI: https://doi.org/10.1007/978-3-030-23085-2

Publisher: Palgrave Macmillan Cham

eBook Packages: Economics and Finance, Economics and Finance (R0)

Copyright Information: The Editor(s) (if applicable) and The Author(s), under exclusive license to Springer Nature Switzerland AG 2019

Hardcover ISBN: 978-3-030-23084-5Published: 20 September 2019

Softcover ISBN: 978-3-030-23087-6Published: 20 September 2020

eBook ISBN: 978-3-030-23085-2Published: 10 September 2019

Series ISSN: 2946-3831

Series E-ISSN: 2946-384X

Edition Number: 2

Number of Pages: XXX, 412

Number of Illustrations: 44 b/w illustrations, 6 illustrations in colour

Topics: Financial Accounting, Business Finance, Accounting/Auditing, Economic Policy