Overview

- The book broadens investors’ skills in analyzing financial markets and providing a blueprint for investing when markets are in turmoil

- It also provides context and lessons for those who have limited experience with bear markets to enable them to cope with future ones

- It encapsulates key developments that shaped the international financial system for readers who are interested in how the current system evolved

Access this book

Tax calculation will be finalised at checkout

Other ways to access

About this book

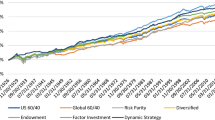

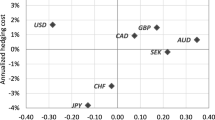

The goal is to share these experiences and the lessons from them, so investors will be better prepared for future shocks. The opening chapter explores whether there are common patterns in movements of interest rates and exchange rates that investors can exploit. A conceptual framework is presented that helps explain why this is the case for traditional currency crises, but less so for asset bubbles.

The concluding chapter ties the episodes together and considers how the nature of financial crises has evolved since the collapse of Bretton Woods. We cite factors that make it difficult for policymakers and investors to detect problems in advance of an asset bubble. The good news is investors get a second chance to outperform when markets are over-sold; however, they need to formulate a strategy to limit the damage during the sell-off phase and to capitalize on the eventual recovery.

Similar content being viewed by others

Keywords

Table of contents (12 chapters)

-

Front Matter

-

Investment Challenges in a High Inflation Era

-

Front Matter

-

-

Easy Credit Breeds Asset Bubbles and Instability

-

Front Matter

-

-

Back Matter

Authors and Affiliations

About the author

Sargen has written extensively on international financial markets, and he currently produces a blog Real-time Financial Thoughts on his website, where his views are updated. He appeared frequently on business television programs throughout his career on Wall Street, and was a regular panelist on Louis Rukeyser’s Wall Street Week. He was born and raised inthe San Francisco Bay Area, and received a PhD in Economics from Stanford University. He is also an adjunct professor at the University of Virginia’s Darden School of Business.

Bibliographic Information

Book Title: Global Shocks

Book Subtitle: An Investment Guide for Turbulent Markets

Authors: Nicholas P. Sargen

DOI: https://doi.org/10.1007/978-3-319-41105-7

Publisher: Palgrave Macmillan Cham

eBook Packages: Economics and Finance, Economics and Finance (R0)

Copyright Information: The Editor(s) (if applicable) and The Author(s) 2016

Hardcover ISBN: 978-3-319-41104-0Published: 16 November 2016

Softcover ISBN: 978-3-319-82267-9Published: 04 July 2018

eBook ISBN: 978-3-319-41105-7Published: 05 October 2016

Edition Number: 1

Number of Pages: XVII, 192

Number of Illustrations: 10 b/w illustrations, 17 illustrations in colour