Overview

- Examines a wide selection of credit and finance schemes affecting vulnerable people around the world, encompassing the global North and global South

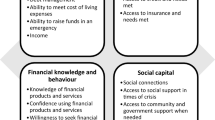

- Draws on a novel combination of a new theory of financialization with well-accepted theories of human development

- Presents a pragmatic analysis and a balanced critique of finance and credit products drawing on recent literature and providing case studies of payday lending and mobile banking

- Features a foreword by Elaine Kempson

Access this book

Tax calculation will be finalised at checkout

Other ways to access

About this book

Similar content being viewed by others

Keywords

Table of contents (7 chapters)

-

Front Matter

-

Back Matter

Authors and Affiliations

About the author

Jerry Buckland is Professor of International Development Studies at Menno Simons College, Canadian Mennonite University, Canada. His research and teaching areas include financial inclusion and empowerment, research and evaluation methods, community-based development, and rural and Indigenous Peoples’ development.

Bibliographic Information

Book Title: Building Financial Resilience

Book Subtitle: Do Credit and Finance Schemes Serve or Impoverish Vulnerable People?

Authors: Jerry Buckland

DOI: https://doi.org/10.1007/978-3-319-72419-5

Publisher: Palgrave Macmillan Cham

eBook Packages: Economics and Finance, Economics and Finance (R0)

Copyright Information: The Editor(s) (if applicable) and The Author(s) 2018

Hardcover ISBN: 978-3-319-72418-8Published: 28 February 2018

Softcover ISBN: 978-3-319-89180-4Published: 06 June 2019

eBook ISBN: 978-3-319-72419-5Published: 19 February 2018

Edition Number: 1

Number of Pages: XXIV, 270

Number of Illustrations: 5 illustrations in colour

Topics: Public Finance, Banking, International Finance